The Hidden Economics of Friendship

The Unspoken Math of Friendship

Why do some friendships feel effortless and rewarding while others slowly fade into resentment or collapse under stress?

Most people don’t think about it. They just assume friendships are about liking someone or having things in common. But under the surface, every friendship is governed by invisible exchanges, a kind of economics.

This is why friendships can feel unfair. Why some people seem to attract lasting, high-quality connections while others struggle. And why even close friends sometimes fail you when you need them most.

If you don’t understand the economics of friendship, you’re playing a game without knowing the rules. And in any game, the player who understands the rules has the advantage.

The Hidden Cost of Friendship

Think of a time you needed help. Maybe you had to move apartments, or you went through a breakup, or you hit a career roadblock. Did your friends “pay out”? Or did you hear excuses, delays, or silence?

It feels personal, but it isn’t always about how much they like you. Sometimes it’s about competing loyalties, hidden costs, or the unspoken math of whether helping you is “worth it.”

Here’s the hard truth:

Friendship is mutual insurance.

You’re both buying and selling coverage.

- Buying coverage: investing time, energy, and care so that when you need it, someone is there.

- Selling coverage: signaling your reliability, trustworthiness, and capacity to help so others keep you in their circle.

The problem is that most people don’t realize they’re in this system. They just follow feelings: “I like them,” “they’re fun to be around.” But feelings are often evolution’s way of nudging us into mutually beneficial insurance contracts without realizing it.

And just like with financial insurance, when payouts fail, relationships crack.

The Social Code

The good news? When you understand the economics of friendship, you can:

- Decode social signals (yours and others’) with clarity.

- Diversify your network the same way you diversify investments.

- Deliver value in ways that strengthen bonds and make you unforgettable.

Let’s break down the framework.

Friendship as Mutual Insurance

Every friendship is a policy. You’re paying premiums in the form of time, attention, emotional labor, and favors. In exchange, you expect coverage when things go wrong.

But unlike financial insurance, you’re both the buyer and the seller.

That means you have two jobs:

- Market yourself as a reliable policy.

- Your reputation, reliability, and ability to help are signals.

- These are like Demonstrations of Higher Value (DHVs) in the pick-up community: subtle ways of showing competence, status, and loyalty without saying it directly.

- Evaluate the reliability of others’ policies.

- Do they show up when it matters?

- Are they signaling trustworthiness or just surface charm?

- Do they have the resources (emotional, financial, intellectual, physical) to cover you if needed?

Most of this doesn’t happen consciously. You don’t do insurance math in your head. You just like someone or you don’t. Unless you’re a sociopath or psychopath, in which case you probably do treat it as sheer calculation.

But here’s the twist: just like sex has been decoupled from reproduction through birth control, friendship today has been decoupled from pure survival through society and technology. We get to enjoy the signals/marketing (humor, vibes, fun) without worrying much about whether the policy will ever pay out. And when it does, it’s often emotional support, not survival-level help.

Beyond Help: The Other Economic Dimensions

If you only think in terms of “help,” friendship looks like a rainy-day fund. But it’s broader than that:

- Information Flow → Friends share opportunities, warnings, and advice. A job lead, an investment tip, or even the right book recommendation can be worth more than physical help.

- Status Signaling → Who your friends are reflects on you. High-status friends act like prestigious “assets” in your social portfolio.

- Risk Pooling → You share not just resources but emotional resilience. Collective support reduces the risk of loneliness, despair, or burnout.

- Network Effects → Friends of friends expand your reach. Just like economies thrive on spillovers, your connections create second-order benefits.

Exchange Rates Between Friends

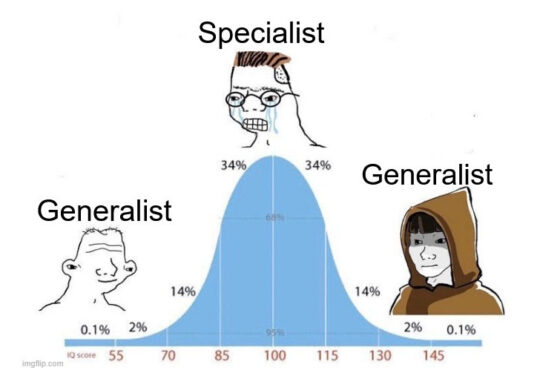

Not all friendships trade at equal rates.

- A single act of help from a skilled friend (introducing you to an investor, offering specialized advice, pulling strings at work) may outweigh dozens of smaller favors from others.

- Some friends are strong currencies: their time, insight, or network has immense value.

- Others are weak currencies: their contributions are smaller but may be easier to get.

Problems arise when exchange rates feel mismatched. One person feels like they’re trading gold for copper. That imbalance creates resentment, if there is an expectation that the exchanges should be fair.

Shared Values, Interests, and Claims

Sooner or later, every friendship will face a payout request. If it happens once and they fail, maybe you forgive. If it happens repeatedly, trust erodes just like when an insurance company denies claims.

Think AIG in 2008: they had the coverage on paper, but when claims flooded in, they couldn’t deliver. The same happens when a friend looks good socially but can’t back it up when tested.

It’s not just about ability to pay out. It’s also about competing policies.

- Family, partners, jobs, religious institutions, and other close friends are primary beneficiaries.

- You may only be a secondary.

That’s why diversification matters. Don’t tie your entire emotional safety net to one person. Spread your social investments across different circles and different levels of status.

How to Improve Your Social Economics

If friendship is an economy, you can increase your value and stability the same way nations grow wealth:

1. Improve Your Social Signals

Signals are your marketing. They show others your reliability and capacity. Vanessa Van Edwards talks about this in Captivate: things like open body language, remembering small details, and displaying competence send subconscious signals of trustworthiness.

But signals aren’t just surface-level charisma. Real value amplifies signals. A funny person who’s also competent in their career signals intelligence and capability. Humor alone is weak currency; humor plus depth is gold.

2. Pay Out When Called Upon

Insurance only works if claims are honored.

- Don’t want to help a friend move? Do it anyway.

- Forget a life event like a birthday or graduation? That damages trust.

- Choose your job, church, or institution over a friend repeatedly? That reveals your true loyalty.

Reputation compounds. One unpaid claim can undo years of premium payments.

3. Get More Value If You Don’t Have Much

Not everyone has a vast network or high-value skills. But you can still build value:

- Be reliable. Many high-status people value loyalty over flash.

- Curate information. Share useful opportunities even if you don’t create them.

- Offer emotional stability. Listening well is an underrated but powerful currency.

Think of it like investing when you don’t have much money: you double down on consistency and discipline.

4. Diversify Your Portfolio

Don’t rely on one person to be your everything. Spread friendships across peers, mentors, and those you mentor. Each plays a different role in your economy.

Key Principles

- Friendship is mutual insurance. You’re always both buying and selling coverage.

- Social signals are your marketing. They display trustworthiness and ability.

- Reputation is an asset. Every payout (or failure to pay) compounds over time.

- Friendship is more than help. It includes information flow, status, risk pooling, and network effects.

- Exchange rates matter. Some currencies are strong, others weak, and imbalance creates resentment.

- Competing policies exist. Family, institutions, and higher-status ties may take priority.

- Diversification protects you. Don’t put all your premiums into one friend.

Key Takeaways

- Stop thinking of friendship as just fun or vibes. It’s an economy.

- Your feelings are the interface; the economics are the operating system.

- Improve your social signals, deliver payouts when called upon, and diversify your network.

- Don’t resent the system, learn it. When you understand the economics of friendship, you stop being at the mercy of others’ hidden calculations and start building intentional, resilient relationships.

Friendship isn’t just about liking people. It’s about managing an economy where your time, energy, and trust are the currency. Play the game consciously, and you’ll never run short on connection again.

Thanks for reading my stuff,

MJ